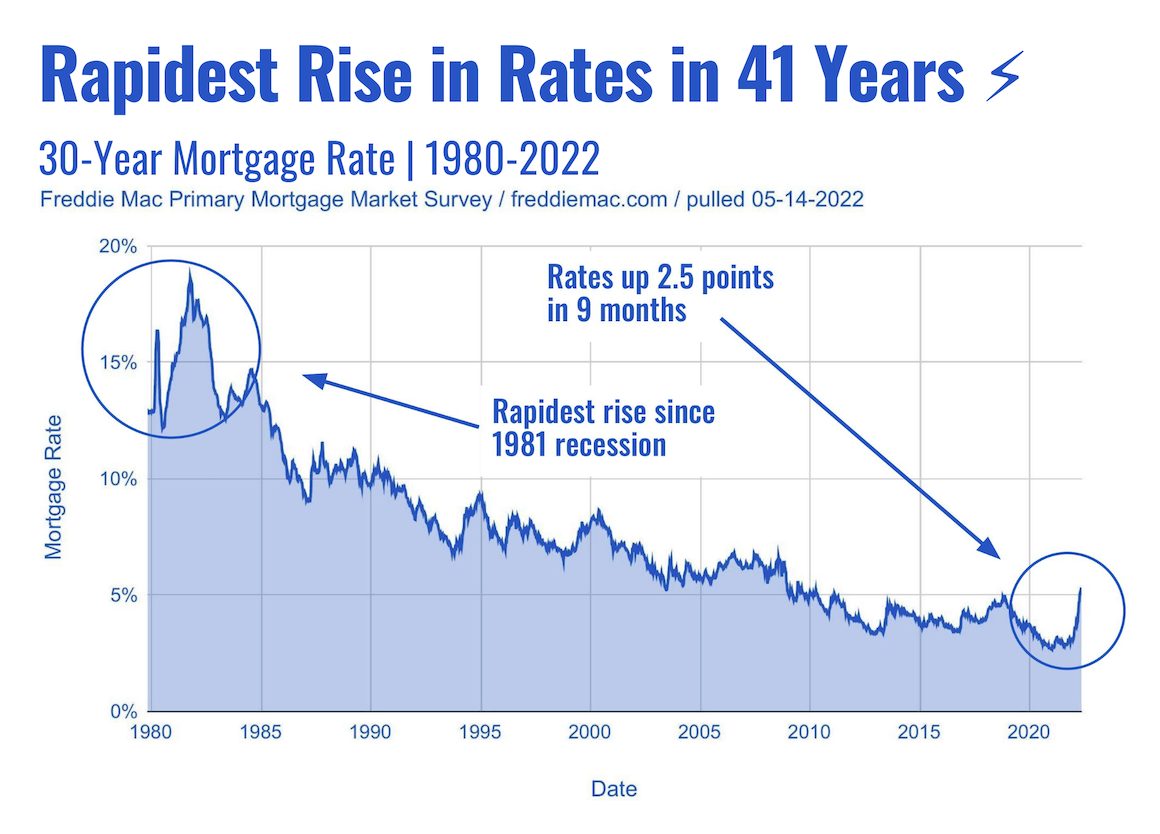

The biggest story in the Greater Ithaca housing market is a national story: the historic rise in mortgage rates.

One way to track mortgage rates is to look at national averages. Freddie Mac, a government-sponsored enterprise that sells mortgage-backed securities, reports national averages on a weekly basis.

According to Freddie Mac’s Primary Mortgage Market Survey®, the average 30-year fixed rate mortgage has increased by more than 2 1/2 percentage points over the past nine months, from 2.75% to 5.25%. This is the rapidest rise in rates in 41 years, since the 1981 recession.

In Greater Ithaca, Mortgage Rate Increase Hurts Buyers

Below are two scenarios that illustrate how the rate increase has effected buyers. Before we dive in, here are some assumptions:

- The 30-year rate was 2.75% back in September and is now 5.25%

- Our hypothetical buyer has found a home for $309,000 (the current median price in greater Ithaca)

- He is putting 20% down and financing 80% through the bank

- He will pay ~35 mills in taxes annually (the City of Ithaca rate)

Mortgage Rates Increase Scenario #1

Back in September, our hypothetical buyer found a home for $309,000. He was ready to put 20% down (or $61,800) and finance 80% (or $247,200). The bank offered him a rate of 2.75% on a 30-year fixed rate mortgage, which came out to $1,009 a month for principal and interest. Taxes on the property are $10,815 annually or $901 a month.

This would have brought his total monthly payment to $1,910.

The problem is, our hypothetical buyer is a dilly dally. He doesn’t get around to submitting his application until today. Now, the bank offers him a rate of 5.25% which comes out to $1,365 a month for principal and interest ($356 more than $1,009). Taxes are still $901 a month.

This brings his total monthly payment to $2,266, which is 19% more than what he would have paid back in September.

That’s 19% more he will have to pay every month for the next 30 years.

Mortgage Rates Increase Scenario #2

This scenario even better illustrates the effect. Let’s say our hypothetical buyer can afford to pay exactly $2,000 a month on principal, interest and taxes.

Back in September, with a rate of 2.75%, $2,000 a month afforded him a house worth $323,438.

Now, with a rate of 5.25%, $2,000 a month affords him a house worth $272,688.

That’s a loss of $50,000 or 16%.

Conclusion

With national mortgage rates on the rise, it has become more expensive for buyers to finance home purchases. This rise is bound to effect buyers in the Greater Ithaca area, and I will be anxiously watching how the market adjusts in the coming months.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link